(Photo: Francisco Gonzalez via Flickr / CC BY 2.0)

Going freelance can happen quickly. You land a first client and suddenly realise you need to make things “official”. In the UK, that usually means registering as a sole trader and making sure you’re meeting HMRC’s requirements from day one.

The good news is that registering as a freelancer in the UK is relatively straightforward. There’s no long approval process or complex paperwork to submit and, in most cases, you can begin trading immediately.

However, while it’s perfectly fine to sort the admin side of thing alongside your first projects, the more organised you are, and the sooner you get into good habits, the better – especially if you’re planning on being freelance for the long haul.

If you’re working for yourself under your own name (or a business name) and not operating through a limited company, you’ll normally be classed as a sole trader. This is the simplest and most common route for freelancers.

Our FAQs below focus purely on sole traders and answers the most common questions people have when they’re trying to get set up properly and stay on the right side of HMRC as early as possible. We hope you find them useful.

FAQs

Do I need to register as a freelancer before I start work?

The short answer to this is ‘no’. You can start working and invoicing clients before you officially register. However, there’s a crucial date to put in your diary and that is 5 October. This is the date by which you must have registered with HMRC as a sole trader following the end of the tax year in which you started trading.

How do I register as a sole trader in the UK?

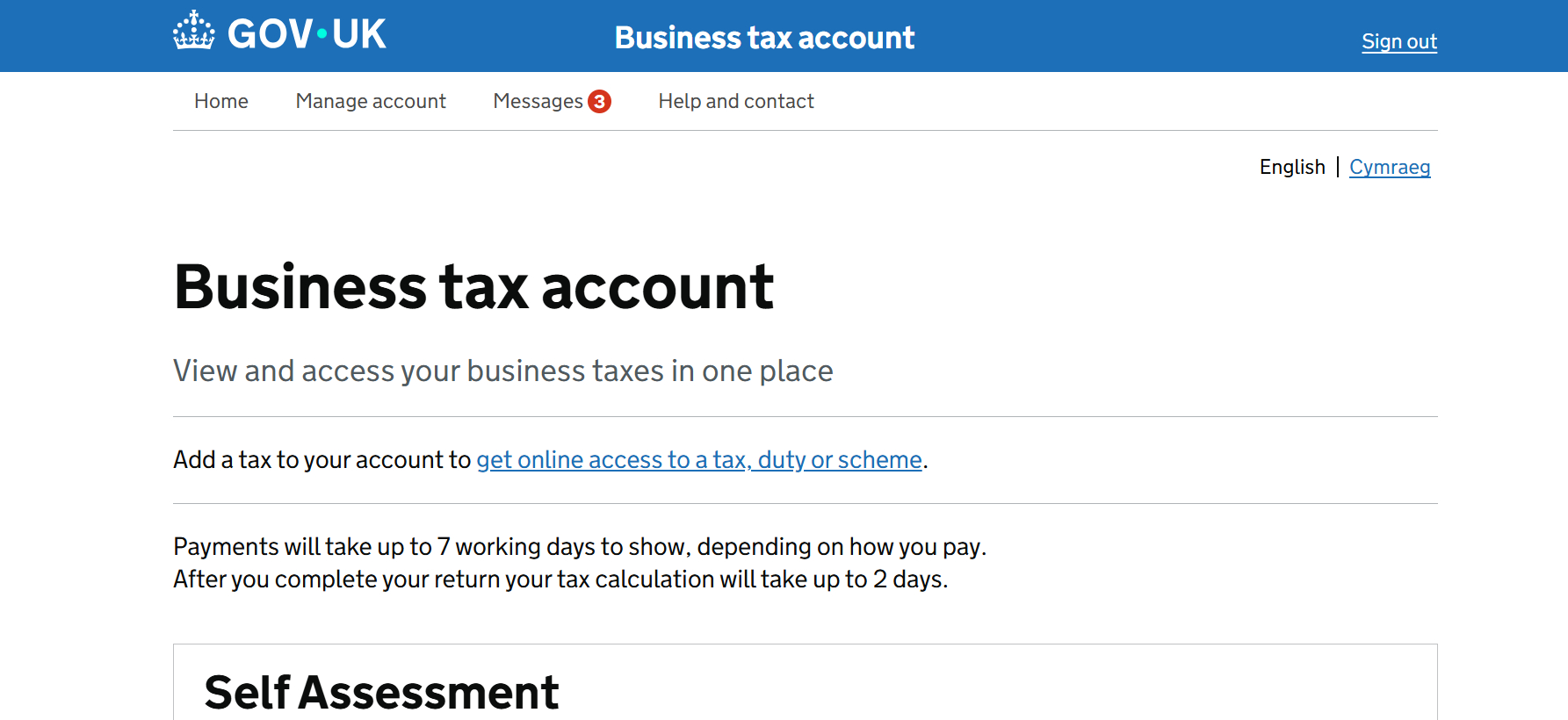

You register online through HMRC by signing up for Self Assessment and declaring that you’re self-employed. This creates your tax record as a sole trader and allows you to submit a Self Assessment tax return each year.

Do I need official confirmation before I can start freelancing?

No. You don’t need approval or confirmation from HMRC before starting work. Once you register, HMRC will issue you with a Unique Taxpayer Reference (UTR), but there’s nothing to stop you legally trading before receiving it.

What is a UTR and how long does it take to arrive?

A UTR (Unique Taxpayer Reference) is a 10-digit number HMRC uses to identify you for tax purposes. After registering, it usually arrives by post within 10 to 15 working days. You’ll need it to file your tax return, but not to begin working.

Do I need a UK bank account to freelance?

Yes, you will need a UK bank account to receive payments from most UK clients.

Do I need a business bank account separate to my personal account?

No, sole traders are allowed to use a personal account, but many freelancers do use separate business accounts as it helps make bookkeeping easier to manage .

Do I need a UK address to register as a freelancer?

Yes, you must provide a UK address when registering with HMRC. This is where official correspondence, including your UTR, will be sent.

Do I need insurance as a freelancer?

There’s no universal legal requirement, but many freelancers need professional indemnity insurance, especially if clients require it in contracts. Public liability insurance may also be relevant depending on your work. Some industries have specific insurance expectations.

Is there a cost to registering as a freelancer?

No, registering as a sole trader with HMRC is free of charge. Your only early costs are likely to be optional, such as insurance, accounting software, or professional advice.

How do payments on account work, and will I need extra cash for my first tax bill?

Payments on account are advance payments toward your next tax bill. In your first payment, you will need to pay both your first year’s tax and part of the next year’s tax upfront. It isn’t extra tax overall, but it can require more cash initially.

What are the benefits of being a sole trader instead of setting up a limited company?

In short, being a sole trader is faster and easier than running a limited company. There’s less admin, lower setup and accounting costs, and more flexibility over how you take money out. For freelancers who want to start quickly, it’s usually the best option.

Am I entitled to statutory workers’ rights as a sole trader, and can I negotiate extra rights?

Sole traders aren’t entitled to the usual statutory employment rights such as sick pay or holiday pay. However, there’s nothing to stop you negotiating protections directly with clients through contracts, including things like notice periods or payment terms.

What if I stop freelancing – how do I make sure I’ve closed things properly?

If you stop freelancing, you should tell HMRC that you’ve ceased trading and submit a final Self Assessment tax return covering your last period of work. You’ll pay any tax owed or receive a refund if you’ve overpaid.